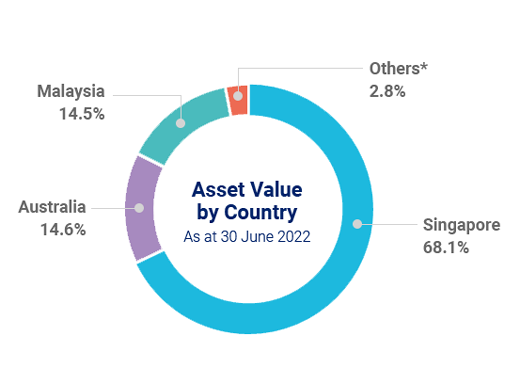

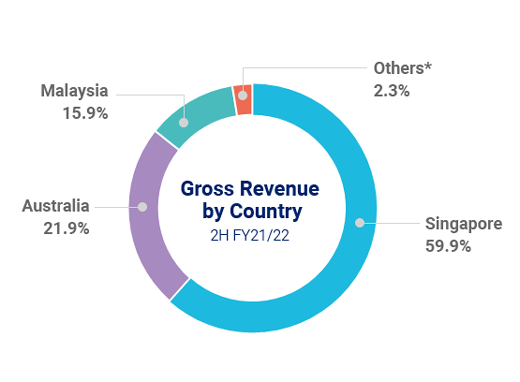

Starhill Global REIT's portfolio comprises 10 mid-to high-end retail and commercial properties in six cities across the Asia Pacific. Core markets include Singapore Australia and Malaysia make up approximately 97% of the total asset value as at 30 June 2022.

(as at 30 June 2022)

Asset Value by Country

Gross Revenue by Country

* Others comprises one property in Chengdu, China, and two properties located in central Tokyo, Japan, as at 30 June 2022.